hotel tax calculator bc

14 rows The following table provides the GST and HST provincial rates since July 1 2010. Some items such as food and books are exempt this tax.

How are hotel taxes and fees calculated.

. Purchase Price 20000. Use our Income tax calculator to quickly estimate your federal and provincial taxes and your 2021 income tax refund. Some communities such as Downtown Victoria have an additional Destination Marketing Fee of 10 which I believe is voluntary.

Your tax per night would be 1950. Destination Marketing Fee 200 x 15 300. On April 1st 2013 the government removed the HST and replaced it by provincial sales tax PST and GST in British-Columbia.

Hotel Room Rates and Taxes. If your business is required to register you must. Who the supply is made to to learn about who may not pay the GSTHST.

Property Tax Calculator. The tax applies not only to hotels and motels but also to bed and breakfasts condominiums apartments and houses. Earners making up to 3110 in taxable income wont need to pay any state income tax as the bottom tax rate in South Carolina is 0.

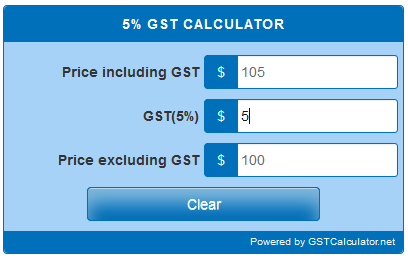

The global sales tax for Bc is calculated from provincial sales tax PST BC rate 7 and the goods and services tax GST in Canada rate 5 for a total of 12. 1 This regulation may be cited as the Hotel Room Tax Regulation. Federal Basic Personal Amount.

In British Columbia an 8 Provincial Sales Tax PST is charged on all short-term room rentals by hotels motels cottages inns resorts and other roofed accommodations. Where the supply is made learn about the place of supply rules. British Columbia Basic Personal Amount.

Type of supply learn about what supplies are taxable or not. All filers are subject to the same income tax brackets regardless of filing status. In 2022 British Columbia provincial government increased all tax brackets and base amount by 21 and tax rates are the same as previous year.

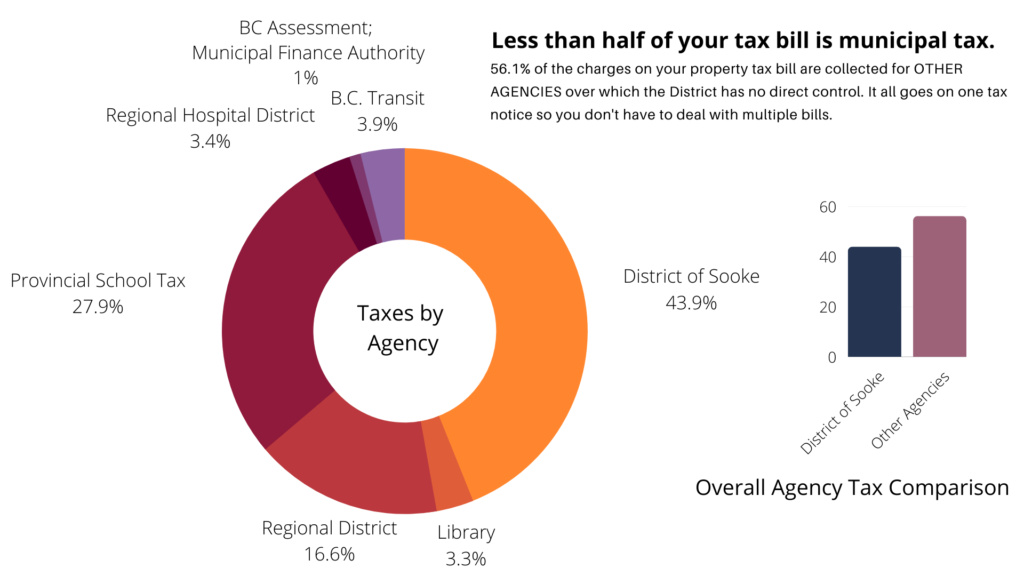

Most goods and services are charged both taxes with a number of exceptions. Provincial Sales Tax PST Bulletin. For example if your hotel is located in Vancouver which is subject to a 2 MRDT and a 15 destination marketing fee and you provide a room in your hotel for 200 per night your guest pays.

MRDT 203 x 2 406. Our income tax calculator calculates your federal state and local taxes based on several key inputs. Taxable income of 15560 or more is subject to South Carolinas top tax rate of 7.

That means that your net pay will be 40568 per year or 3381 per month. The PST for other goods and services is set at 7. Multiply the answer by 100 to get the rate.

British Columbia Personal Income Tax Brackets and Tax Rates in 2022. For a summary of the changes see Latest Revision at the end of this document. Base amount is 11302.

If you need to find out the exact property tax owed on any property you can contact the local property tax assessor for the. 8 rows Income Tax Calculator British Columbia 2021. How Income Taxes Are Calculated.

Find out if your business is required to register to collect PST. Ministry of Finance PO Box 9442 Stn Prov Govt Victoria BC V8W 9V4. Campsite and RV site bookings are exempt from any PST.

For use in BC unless a specific exemption applies. Kelownas DMF may be 15. PST 203 x 8 1624.

Enter the zip code in which the property is located to estimate your property tax. British Columbia is one of the provinces in Canada that charges separate 7 Provincial Sales Tax PST and 5 federal Goods and Services Tax GST. Local hotel taxes apply to sleeping rooms costing 2 or more each day.

The rate you will charge depends on different factors see. This is any monetary amount you receive as salary wages commissions bonuses tips gratuities and honoraria payments given for professional services. GST 5 PST 7 on most goods and services.

Hotels in most parts of BC will be 15 5 GST 8 PST short term accommodaton only 2 MRDT formerly known as Hotel Tax. Charge and collect PST at the time the tax is. For example the total cost of a nights stay is 13450 with the rooms pre-tax cost at 115.

What is the most recent assessed value of your property. Current GST and PST rate for British-Columbia in 2019. Property taxes in South Carolina remain low.

The revision bar identifies changes to the previous version of this bulletin dated April 2022. From 86141 to 98899. Estimate My Property Tax.

Age Amount Tax Credit 65 years of age 789800. If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432. Hotel owners operators or managers must collect state hotel occupancy tax from their guests who rent a room or space in a hotel costing 15 or more each day.

To get the hotel tax rate a percentage divide the tax per night by the cost of the room before taxes. Your household income location filing status and number of personal exemptions. Provincial Sales Tax Act.

GSTPST Calculator Before Tax Amount. Select hotels in Vancouver levy an additional 15 Destination Marketing Fee DMF on top of the 2 MRDT which makes a total of 35 additional taxes on some accommodation in Vancouver. 2 Municipal and Regional District Tax MRDT on lodging in 45 municipalities and regional districts.

From 0 to 43070. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. This marginal tax rate means that your immediate additional income will be taxed at this rate.

22 Accommodation includes the provision of lodging in a lodging houses boarding houses rooming houses resorts bed and breakfast establishments and similar places. Estimate Your Property Tax. Provincial sales tax PST is a retail sales tax that applies when taxable goods or services are purchased acquired or brought into BC.

21 In this regulation unless the context otherwise requires section 1 of the Act shall apply. Age Amount Tax Credit reduced when income exceeds. Reverse GSTPST Calculator After Tax Amount.

Your average tax rate is 220 and your marginal tax rate is 353. From 43071 to 86140.

Smythe Llp Possible Changes Coming To Tax On Capital Gains In Canada

Bc Sales Tax Gst Pst Calculator 2022 Wowa Ca

Mortgage Formula Cheat Sheet Home Loan Math Made Simple Mortgage Loans Mortgage Rates Today Types Of Loans

How To Complete A Canadian Gst Return With Pictures Wikihow

British Columbia Property Tax Rates Calculator Wowa Ca

Vancouver Tax Accountant Surrey Accountant Burnaby Accountant

Calculate Import Duties Taxes To Canada Easyship

Alberta Gst Calculator Gstcalculator Ca

3 Methods To Calculate Your Gst Sharon Perry Associates Cpa

5 Percent Gst Calculator Gstcalculator Net

Income Tax Calculation 2019 इनकम ट क स Calculate करन क सबस आस न तर क 2019 20 Youtube

Bc Sales Tax Gst Pst Calculator 2022 Wowa Ca

Best Tax Return Softwares In Canada 2022 Greedyrates Ca

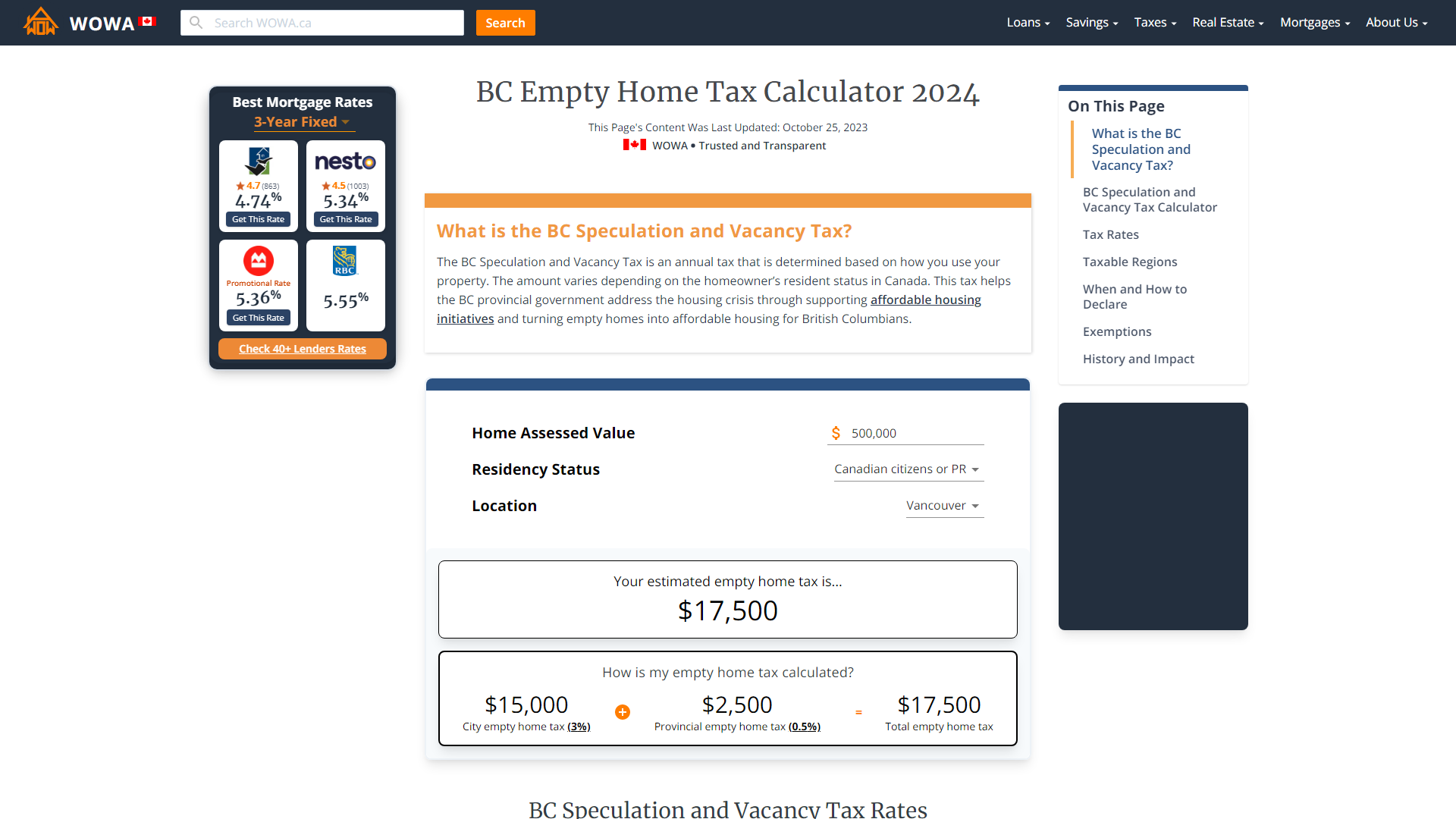

British Columbia Empty Home Tax Calculator 2022 Wowa Ca

Income Tax Calculation A Y 2021 22 New Income Tax Rates 2021 New Tax V S Old Tax A Y 2021 22 Youtube

Close Up Businessman And Partner Using Calculator And Laptop For Calaulating Finance Tax Accounting Statistics And Analytic In 2022 Business Man Finance Accounting