sacramento property tax rate 2020

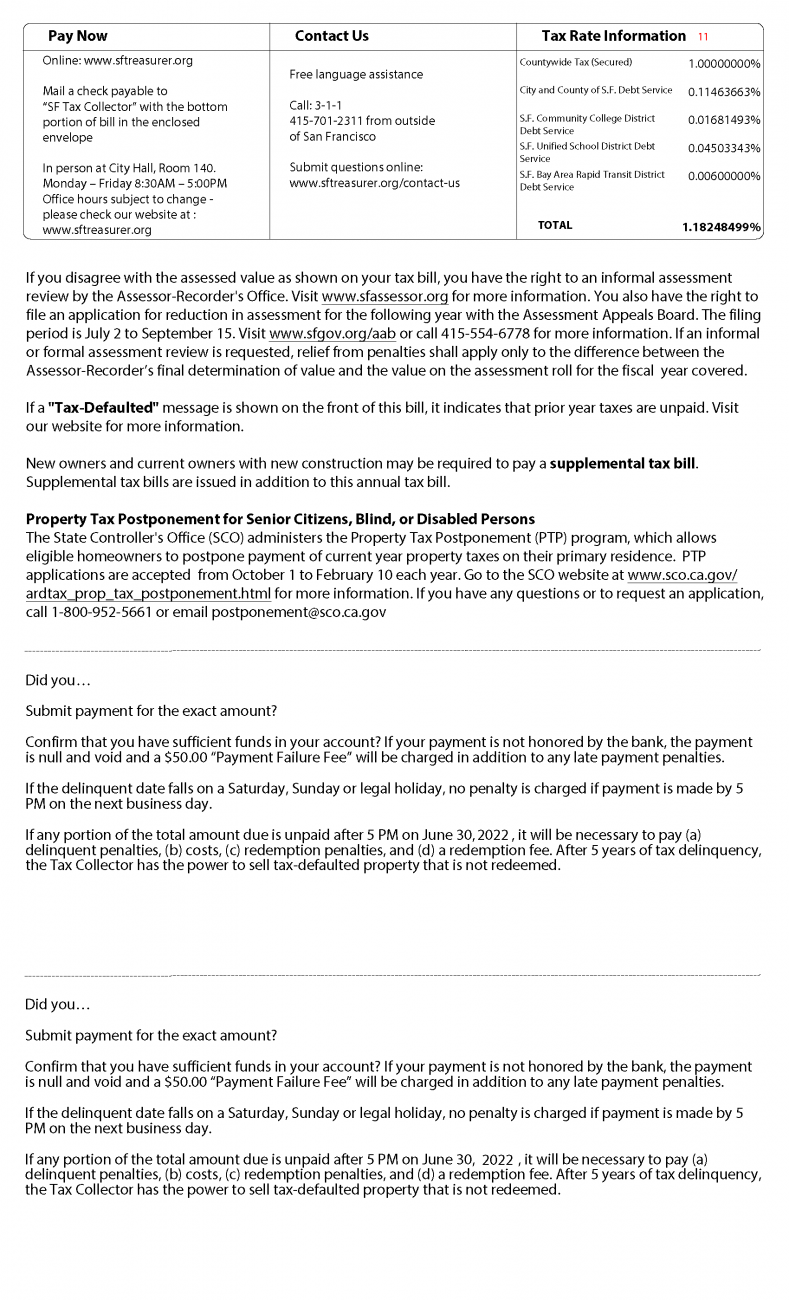

Revenue and Taxation Code Sections 605115 620115. In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well 2020-59.

Riverside County Ca Property Tax Calculator Smartasset

For a list of your current and historical rates go to the California City County Sales Use Tax Rates webpage.

. PO BOX 942879 SACRAMENTO CALIFORNIA 94279-0064. Overview of California Taxes Californias overall property taxes are below the national average. Look up the current sales and use tax rate by address.

Its also home to the state capital of California. 025 to county transportation funds. Order setting tax rate for the county of johnson for the 2020 tax year and directing the assessment and collection thereof.

Finance 700 H Street Room 1710 First Floor Sacramento CA 95814 916-874-6622 or e-mail Additional Information. 450 N STREET SACRAMENTO CALIFORNIA. City level tax rates in this county apply to assessed value which is equal to the sales price of recently purchased homes.

The Bryan County Tax Assessor is responsible for assessing the fair market value of properties within Bryan County and determining the property tax rate that will apply. In comparison you can find property with lower tax rates of 10995 in some parts of Folsom City. The average effective property tax rate in California is 073 compared to the national rate which sits at 107.

Property Type 2020 2019 Change Change 2020 2019 Change Change Vacant Land - Residential 16832 16421 411 25 2150977648 2003590342 147387306 74 Single Family Residences 384023 380260 3763 10 115292649366 108723604319 6569045047 60. Property Tax Bills Payments. Tax Collection and Licensing.

The new district tax is for specified city limits and only affects the City of Sacramento. 2020-21 CALIFORNIA CONSUMER PRICE INDEX Revenue and Taxation Code section 51 provides that base year values determined under. The California Constitution mandates that all property is subject to taxation unless otherwise exempted by state or federal law.

Sales tax will increase from 825 to 875 percent. Proposition 13 enacted in 1978 forms the basis for the current property tax laws. Erie county tax sale 2020 Explore The Guide.

This does not include personal unsecured property tax bills issued for boats business equipment aircraft etc. View the E-Prop-Tax page for more information. 075 to city or county operations.

California City County Sales Use Tax Rates effective April 1 2022 These rates may be outdated. Sheriff - Bill E. Revenue and Taxation Code Section 72031 Operative 7104 Total.

The Sacramento County fiscal year starts July 1st when the assessment roll is completed. Annual property taxes are due in two installments through the fiscal year. PROPERTY TAX DEPARTMENT.

1-916-274-3350 FAX 1-916-285-0134 wwwboecagov December 27 2019. The tax rate change effective April 1 2019 is a citywide sales and use tax rate increase for the City of Sacramento and will be one half of one percent 05. When Property Taxes Are Due.

Sacramento County is located in northern California and has a population of just over 15 million people. 2020-2021 compilation of tax rates by code area code area 03-014 code area 03-015 code area 03-016 county wide 1 10000 county wide 1. See detailed property tax information from the sample report for 2526 H St Sacramento County CA.

Sacramento county 2019-2020 compilation of tax rates by code area code area 03-017 code area 03-018 code area 03-019 county wide 1 10000 county wide 1 10000 county wide 1 10000 los rios coll gob 00232 los rios coll gob 00232 los rios coll gob 00232 sacto unified gob 01139 sacto unified gob 01139 sacto unified gob 01139. What is California property tax rate 2020. The property tax rate in the county is 078.

This is a combined property tax rate of 11295.

Property Tax California H R Block

Property Taxes Department Of Tax And Collections County Of Santa Clara

How To Sell Houses Fast Through Real Estate Investors Real Estate Investor Real Estate Investing Real Estate Development

Homeownership Rate In The U S Climbs To Highest Since 2013 Home Ownership Mortgage California

3745 Las Pasas Way Sacramento Ca 95864 Mls 19036325 Zillow Home Loans Home Inspector Zillow

The Best And Worst U S States For Taxpayers Tax Deadline States Virginian Pilot

Interactive Map Shows How Much Property Tax Most Californians Pay Compared With Neighbors

1605 North Delaware Street Pretty House House Styles Luxury Homes

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

Secured Property Taxes Treasurer Tax Collector

Sacramento County Ca Property Tax Search And Records Propertyshark

Best Cpa In Carson County Nv Business Valuation Nevada Cpa

Sacramento Ca Weather Forecast And Conditions The Weather Channel Weather Com The Weather Channel Weather Forecast Weather

Secured Property Taxes Treasurer Tax Collector

Secured Property Taxes Treasurer Tax Collector

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

How To Calculate Property Tax Everything You Need To Know New Venture Escrow